Last weekend, Obama released major components of his budget. The Wall Street Journal highlighted some of the key takeaways:

The real news in Mr. Obama's budget proposal is the story of those four years, and what a tale they tell.

• Four years of spending of more than 24% of GDP, the four highest spending years since 1946. In the current fiscal year of 2012, despite talk of austerity, Mr. Obama predicts spending will increase by $193 billion to $3.8 trillion, or 24.3% of GDP. The top chart shows the unprecedented four-year blowout.

• Another deficit of $1.327 trillion in 2012, also an increase from 2011, and making four years in a row above $1.29 trillion. The last time that happened? Never.

• Revenues at historic lows because of the mediocre recovery and temporary tax cuts that are deadweight revenue losses because they do so little for economic growth. The White House budget office estimates that for the fourth year in a row revenues won't reach 16% of GDP. The last time they were below 16% for any year was 1950.

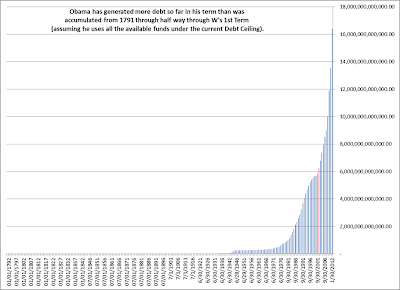

• All of this has added as astonishing $5 trillion in debt in a single Presidential term. National debt held by the public—the kind you have to pay back—will hit 74.2% this year and keep rising to 77.4% next year. The bottom chart shows the trend.

The Wall Street Journal also highlighted the truth in the "Budget" if it passes:

The only thing that you can be certain will become law in this budget if Mr. Obama is re-elected is the monumental tax increase. His plan would raise tax rates across the board on anyone or any business owners making more than $200,000 for individuals and $250,000 for couples. These are the 3% of taxpayers that Mr. Obama says aren't paying their fair share, though that 3% pays more in income tax than the rest of the other 97%.

Paul Ryan, the House Budget Guru dissects the "Budget."

Republican House member Scott Garett from New Jersey questioned OMB Acting Director Jeffrey Zients at the House Budget Committee. If you didn't know better, you would think the asnwers were altered:

The budget fails to address the fiscal crisis. Does Obama want another debt ceiling debate on the eve of the election? The Washington Times had this to say about the debt ceiling:

The United States Department of Treasury will reach the the statutory limit it is allowed to borrow money before election day, according to a new study by Sen. Rob Portman, R-Ohio., former director of the U.S. Office of Management and Budget.

“Following the contentious debt ceiling last August, President Obama promised that he would take action to address the country’s fiscal crisis. He has failed to do that," Portman said. "In fact, his new budget increases spending and projects that Washington will be hitting the debt ceiling again in mid-October – burning through a $2.1 trillion debt limit increase in just over 14 months."

Portman's office notes that according to Obama's budget, total debt subject to the statutory debt will reach limit will reach $16.334 trillion by September 30, 2012. This is just $60 billion below the 16,394,000,000,000 debt limit. Since the federal government is adding to the national debt at a rate of $132 billion a month, the debt ceiling is on schedule to be reached by October 15, 2012.

" This is an unfortunate but clear signal to the American people that Washington is spending too much, borrowing too much, and putting our nation’s fiscal stability at risk," Portman said.

You may remember Obama calling George Bush "unpatriotic" for the debt he generated. Well, if Senator Portman is correct, then Obama will be in a class by himself (no transcript required). He would have generated more debt in four years than was generated from 1791 to halfway through W's first term.

No comments:

Post a Comment

No profanity, keep it clean.

Note: Only a member of this blog may post a comment.